How U.S. Pharmaceutical Tariffs Are Impacting Supply Chains and Medication Distribution

How U.S. Pharmaceutical Tariffs Are Impacting Supply Chains and Medication Distribution

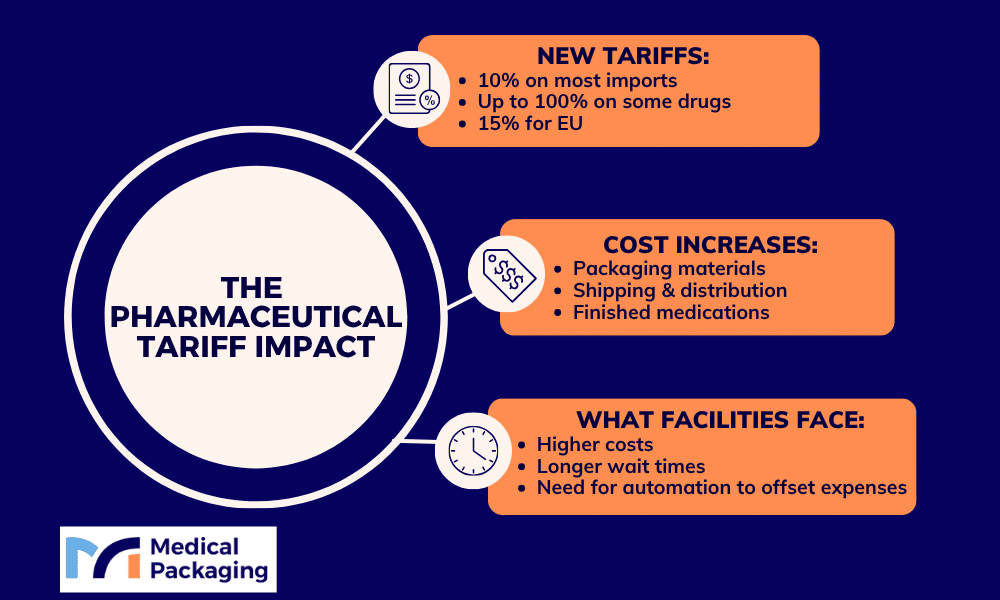

This year, the Trump administration implemented sweeping pharmaceutical tariffs that have fundamentally reshaped how medications reach American patients. A baseline 10% global tariff now applies to most pharmaceutical imports, with a proposed 100% tariff on branded and patented drugs under consideration. These tariffs directly increase costs for imported active pharmaceutical ingredients, finished medications, and essential packaging materials—expenses that flow through every level of the supply chain.

The financial impact extends from manufacturers importing raw materials to hospitals purchasing finished medications. For healthcare facilities, pharmacies, and pharmaceutical manufacturers, these tariffs translate to higher procurement costs, supply chain disruptions, and difficult decisions about sourcing strategies. This guide examines how tariff policies influence packaging decisions, distribution strategies, and operational efficiency across the pharmaceutical sector.

Understanding the Current U.S. Pharmaceutical Tariff Landscape

The new trade policies have introduced substantial changes to pharmaceutical imports, creating new cost pressures throughout the pharmaceutical industry. In April 2025, the White House issued an executive order establishing a baseline 10% global tariff on most imports. Additional pharmaceutical-specific policies followed, including a proposed 100% tariff on branded and patented drugs announced in September 2025, though implementation has been delayed pending completion of a Section 232 national security investigation by the Commerce Department.

How Tariffs Impact Different Pharmaceutical Products

The Commerce Department classifies pharmaceutical tariffs into three primary categories:

- Active Pharmaceutical Ingredient Tariffs: Recent U.S. tariff policy has introduced two major changes affecting active ingredients used in drug manufacturing:

- Temporary 10% Global Tariff: Applies broadly to pharmaceutical imports regardless of source country, affecting the base cost of active pharmaceutical ingredients across the supply chain.

- Proposed 100% Tariff on Patented Drugs: Specifically targets brand-name medications, creating distinct cost pressures that differ significantly from generic drugs.

Proposed tariff discussions have raised concerns among Indian drugmakers, who supply a large share of the U.S. generic drug market.

Finished Pharmaceutical Product Tariffs: Completed medications and their primary packaging face varying tariff rates depending on source country and trade agreements. For hospitals and pharmacies receiving pharmaceutical imports, these higher tariffs translate directly into higher prices at the point of purchase.

Packaging Materials and Medical Devices: The tariff framework extends to packaging materials themselves, including glass vials, plastic containers, protective materials, and specialized medical devices used in pharmaceutical packaging. These materials face the same tariff structures as other imported goods, creating cost pressures throughout the supply chain.

Regional Trade Impact

Tariff implementation varies significantly by region. The United States implemented a baseline 10% global tariff on imports in April 2025 as part of the administration’s reciprocal tariff policy. North American pharmaceutical manufacturers benefit from certain provisions under the USMCA trade agreement, though cross-border exchanges still face new documentation requirements.

A trade framework was negotiated between the United States and the European Union in July and August 2025, in which the US agreed to cap tariffs on certain EU products, including pharmaceuticals, at 15%. This agreement provides relative certainty for EU-based suppliers and covers both branded pharmaceuticals and most pharmaceutical packaging materials from EU sources. The Asia-Pacific region has experienced more varied tariff exposure, with pharmaceutical companies sourcing from Chinese manufacturing facilities and Indian drugmakers facing the baseline global tariff rates without negotiated caps.

The chief economist at several pharmaceutical industry associations has noted that these tariff structures continue evolving through public comments periods and tariff announcements from the Commerce Department, requiring pharmaceutical manufacturers to regularly update their supply chain strategies.

Direct Cost Impacts on Pharmaceutical Supply Chains

Rising Material Costs for Healthcare Facilities

The pharmaceutical supply chain has experienced significant cost pressures as higher tariffs flow through to end users. For hospitals, extended care facilities, and retail pharmacies, these increases affect both the medications themselves and the packaging systems used for patient safety and compliance. Research from the Journal of Managed Care & Specialty Pharmacy and similar sources indicates that trade and supply disruptions, including tariffs, can raise pharmaceutical costs and limit patient access.

Primary Packaging Cost Increases

Primary packaging materials for injectable medications and oral medications have seen price increases due to tariffs on imported pharmaceutical goods. These higher costs particularly impact specialty pharmaceutical manufacturers and contract development organizations who package medications for multiple clients.

Secondary and Protective Packaging

Corrugated materials, protective inserts, and temperature-controlled shipping containers all face tariff exposure when sourced internationally. Long-term care pharmacies that repackage medications into unit-dose formats have reported increased costs for blister materials and protective packaging components.

Compliance and Safety Packaging

Child-resistant closures, tamper-evident seals, and specialized barrier materials required for pharmaceutical product integrity have become more expensive under the new tariff structure. These are critical inputs that healthcare facilities cannot compromise on, regardless of cost pressures.

Impact on Pharmaceutical Repackagers

Pharmaceutical repackagers face unique challenges under current tariff policies. These operations depend on efficient, high-volume packaging systems to serve hospitals, nursing homes, and retail pharmacies. Higher costs for packaging materials directly affect their ability to provide cost-effective unit-dose packaging services.

Many repackagers are now evaluating domestic manufacturing sources for packaging materials to reduce tariff exposure. However, this transition requires careful validation to ensure materials meet FDA standards for pharmaceutical packaging and labeling.

Pharmacist organizing products on shelves in a brightly lit pharmacy interior.

Supply Chain Adaptations Across the Pharmaceutical Industry

Domestic Manufacturing and Production Shifts

The pharmaceutical sector is responding to higher tariffs by accelerating domestic production initiatives. Pharmaceutical companies are evaluating whether to establish or expand manufacturing facilities within the United States to serve domestic demand while avoiding import tariffs.

New Manufacturing Plants: Several major pharmaceutical manufacturers, including Eli Lilly, have expanded U.S. production to strengthen domestic supply chains and reduce reliance on imports. Key considerations include:

- Addresses national security concerns about pharmaceutical supply chains

- Requires substantial capital investment

- Typically takes 3-5 years from planning to completion

- Helps pharmaceutical companies avoid ongoing import tariff costs

Domestic Packaging Capabilities: Pharmaceutical manufacturers are also investing in domestic packaging operations, including:

- Automated filling lines for high-volume production

- Advanced labeling systems that ensure compliance and reduce errors

- Quality control equipment for specialized pharmaceutical products

- Integrated systems that handle both generic drugs and brand-name medications

Regional Supply Chain Networks

To manage tariff exposure, pharmaceutical companies are restructuring their distribution networks around regional manufacturing and distribution hubs. Rather than relying on single-country sourcing, organizations now maintain relationships with suppliers across multiple regions.

Strategic Distribution Centers: Pharmaceutical goods now flow through strategically positioned warehouses that minimize tariff costs while maintaining market access. Key changes include:

- Repositioning distribution centers to optimize for tariff structures

- Consolidating smaller warehouses into larger regional hubs

- Working with group purchasing organizations to adjust delivery patterns

- Hospitals and health systems experiencing changes in how pharmaceutical products reach their facilities

Multi-Source Strategies: Drug companies are developing secondary supply pathways to reduce dependency on any single manufacturing facility or import route. Benefits of this diversification include:

- Prevention of drug shortages when tariff policies change unexpectedly

- Reduced risk when one supply route experiences disruptions

- Greater flexibility to shift sourcing based on tariff rate changes

- Improved supply chain resilience for critical medications

Inventory Management Changes

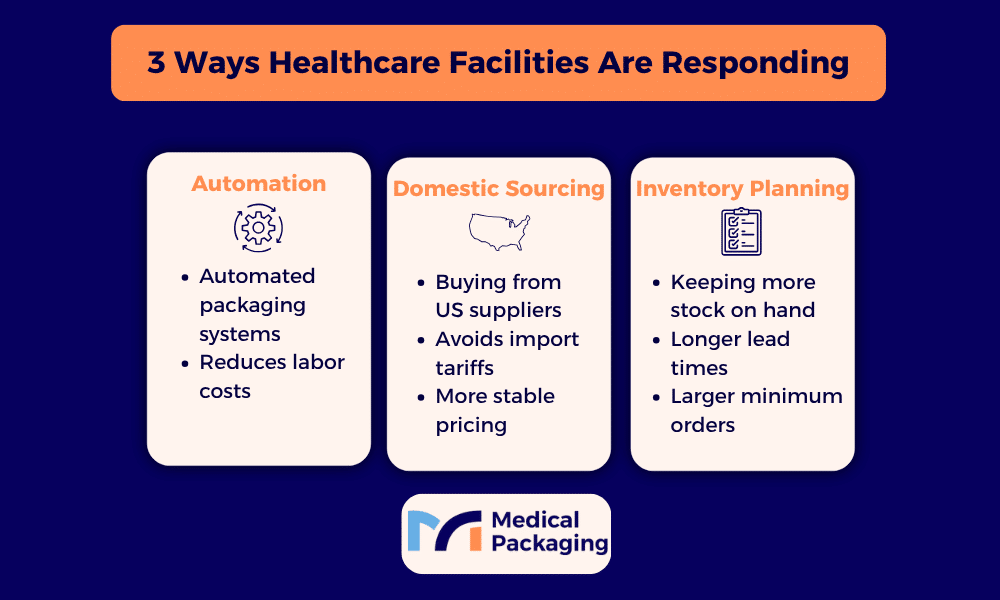

The pharmaceutical industry has adjusted inventory strategies in response to tariff uncertainty and the risk of drug shortages. Healthcare facilities are experiencing these changes through altered ordering patterns and stock levels.

Many pharmaceutical manufacturers now maintain higher inventory levels of critical medications to protect against supply disruptions. This requires additional warehouse space and capital investment in inventory, costs that ultimately flow through to hospitals and pharmacies.

The traditional just-in-time inventory model that minimized storage costs is giving way to just-in-case approaches that prioritize availability over efficiency. Long-term care pharmacies and acute care facilities need to plan for potentially longer lead times and larger minimum orders.

Practical Solutions for Healthcare Facilities

Optimizing Supply Chain Operations

Healthcare facilities can take specific steps to manage cost pressures while maintaining safety and compliance:

Automation Investment: Automated packaging and labeling systems reduce labor costs and minimize errors, helping offset higher material costs from pharmaceutical tariffs. Independent pharmacies and small hospital systems can now access right-sized automation that fits their volume needs without requiring massive capital investment.

Integrated Systems: Rather than cobbling together separate solutions for different packaging needs, integrated platforms streamline workflows and reduce the complexity of managing compliance burdens. This is particularly valuable for specialty pharmaceutical manufacturers handling multiple product lines with varying regulatory requirements.

Smart Packaging Technology: Advanced packaging solutions with built-in tracking and verification capabilities help prevent labeling errors while providing the documentation needed for regulatory compliance. These systems integrate into existing workflows without requiring complete operational overhauls.

Working with Reliable Partners

In an environment of tariff uncertainty and supply chain disruption, healthcare facilities need packaging partners who understand both compliance requirements and cost optimization.

Partners with domestic manufacturing capabilities can provide more stable pricing and reduce exposure to international tariff fluctuations. This is increasingly important as the pharmaceutical sector shifts toward domestic production.

Packaging systems should accommodate both low-volume specialty medications and high-volume generic drugs without requiring separate equipment or processes. This flexibility becomes critical as pharmaceutical companies adjust product mixes in response to tariff pressures.

Looking Ahead: The Future of Pharmaceutical Distribution

Ongoing Policy Development

The pharmaceutical tariff landscape continues evolving through executive orders, public comments periods, and international trade negotiations. The Department of Commerce regularly issues new tariff announcements that affect pharmaceutical imports and domestic demand patterns.

Healthcare facilities should monitor these developments through industry associations like the Healthcare Compliance Packaging Council and Pharmaceutical Research and Manufacturers of America. Understanding policy direction helps organizations make informed decisions about:

- Inventory levels and strategic stockpiling

- Supplier relationships and sourcing strategies

- Capital investments in automation and packaging systems

- Long-term contracts and pricing agreements

Industry Adaptation Strategies

The pharmaceutical industry is developing long-term strategies to manage tariff impacts while ensuring medication availability:

Domestic Manufacturing Growth: Expect continued expansion of pharmaceutical manufacturing facilities within the United States, driven by:

- National security concerns about pharmaceutical supply chains

- Economic pressure of higher tariffs on pharmaceutical imports

- Government incentives for domestic production

- Patient demand for reliable medication access

Supply Chain Resilience: Drug companies are building more flexible supply chains that can quickly adapt to changing tariff policies or supply disruptions through:

- Maintaining relationships with suppliers across multiple regions

- Developing alternative sourcing for critical inputs and active pharmaceutical ingredients

- Creating redundancy in manufacturing and distribution networks

- Establishing contingency plans for tariff-related disruptions

Technology Integration: Advanced tracking systems, automated quality control, and smart packaging technologies help offset cost pressures while improving safety and compliance. Key innovations include:

- Real-time supply chain visibility and tracking

- Automated quality control that reduces labor costs

- Smart packaging with built-in verification and traceability

- Integrated systems that streamline compliance documentation

Navigating Change with MPI

U.S. pharmaceutical tariffs have permanently altered the economics of pharmaceutical supply chains and medication distribution. Higher prices for active pharmaceutical ingredients, finished medications, and packaging materials create ongoing cost pressures for healthcare facilities across all market segments.

Organizations that proactively address these challenges through operational improvements, strategic partnerships, and smart technology investments can maintain efficiency while controlling costs. Medical Packaging Inc., LLC provides innovative packaging and labeling solutions designed specifically for these challenges. Our automated systems help healthcare professionals streamline operations, reduce labeling errors, and maintain compliance even as supply chains evolve and cost pressures increase.

Ready to optimize your pharmaceutical packaging operations? Contact MPI today to discuss how our integrated packaging and labeling systems can help you navigate tariff impacts while improving operational efficiency.

Content

- How U.S. Pharmaceutical Tariffs Are Impacting Supply Chains and Medication Distribution

- Understanding the Current U.S. Pharmaceutical Tariff Landscape

- Direct Cost Impacts on Pharmaceutical Supply Chains

- Supply Chain Adaptations Across the Pharmaceutical Industry

- Practical Solutions for Healthcare Facilities

- Looking Ahead: The Future of Pharmaceutical Distribution

Contact MPI Today for Personal Assistance

MPI’s Drug Master File provides speed-to-market regulatory and technical support related to our packaging components for medical and pharmaceutical market clients