Medical Equipment Planning

As technological advancements continue to become more complex and the healthcare industry races to keep up, proper planning of medical equipment is becoming increasingly vital.

Reducing Medication Errors for Healthcare Providers

Healthcare is a field where precision is non-negotiable. One area where accuracy critically matters is medication administration. Lapses in this area can lead to medication errors, potentially causing severe patient harm or even fatal outcomes.

Insulin Shortage Updates, Causes & Resolutions

The U.S. is currently experiencing a significant increase in drug shortages, reaching a decade-high with 323 active shortages in the first quarter of 2024. These shortages primarily affect generic sterile injectable medicines like various types of insulin due to factors like economic pressures, manufacturing complexities, and supply chain vulnerabilities.

Pharmaceutical Supply Chain Management: Key Steps & Challenges

In recent years, supply chain problems have significantly impacted many industries, including the pharmaceutical sector. Addressing these challenges is essential, as the pharmaceutical supply chain is a critical component of patient care. Any disruption in this process can negatively affect patient safety and the healthcare industry.

Hospital Inventory Management Best Practices

Hospital inventory management is an essential part of improving patient safety and patient outcomes while also reducing inventory costs. Challenges to the health care industry, such as supply shortages and human error, make health care inventory management important. Following best inventory management practices can help hospital administrators achieve better inventory control while remaining in compliance with regulations and handling difficulties within the industry.

What is a CDMO & How are They Revolutionizing the Pharmaceutical Industry?

A CDMO (Contract Development and Manufacturing Organization) is a company that provides comprehensive services from drug development through drug manufacturing for pharmaceutical and biotech firms. They are revolutionizing the pharma industry by streamlining the drug development and manufacturing process, enabling faster, more efficient, and cost-effective production of pharmaceutical products.

Breaking Down the Drug Shortages of 2024

The landscape of healthcare in the United States often feels as intricate and complicated as the human body itself. In recent times, one of the greatest challenges stirring concern among professionals and patients alike has been the drug shortages of 2024. These shortages have broad-reaching implications, affecting everything from the supply chain management of pharmaceuticals to the availability of lifesaving, critical drugs for patients in need.

AI in Clinical Trials: The Future of Medicine

Much has changed and continues to evolve in clinical trials since the advent of artificial intelligence. Artificial intelligence (AI) — the simulation of human intelligence in machines — has become an instrumental force in modern healthcare. It is rapidly transforming the landscape of clinical research, especially in the processes related to clinical trials.

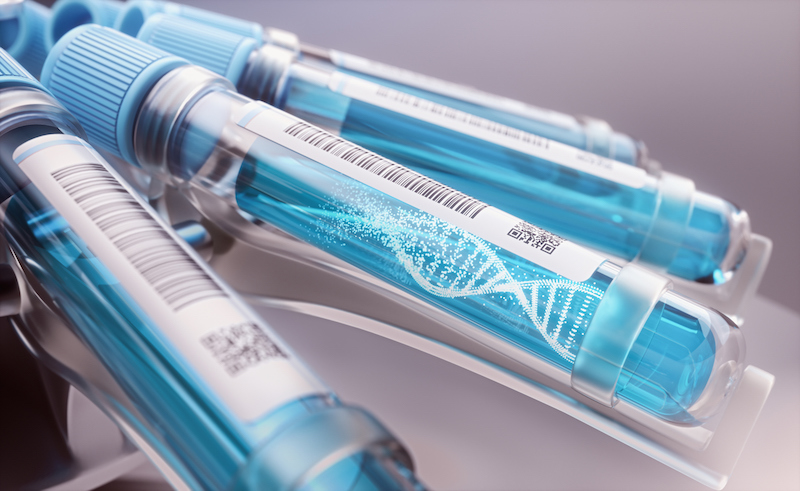

Smart Packaging Technologies for Improving Medical Packaging

In the fast-paced consumer goods industry, one innovation is quietly reshaping how we think about packaging: Smart Packaging. Smart packaging integrates science and technology to create packaging solutions that use digital identifiers to monitor product quality and track a package’s journey. Smart packaging of consumer goods is used in food and beverage, retail, automotive, electronics, and medical industries.

Medication Repackaging Guidelines: Best Practices for Safety and Efficiency

Prescription drug manufacturers often produce medications on a large scale. Pharmaceutical repackagers then acquire these medications in bulk and repackage them for distribution across diverse pharmacy markets within the healthcare industry.